The insurance claims process is how policyholders request financial compensation when an unexpected event occurs. Whether it’s a car accident, home damage, medical treatment, or other covered incident, filing a claim is your way of asking your insurance company to help you recover financially. This process can seem complicated, but understanding its basics helps reduce stress during already challenging times. Insurance claims protect you from significant financial losses by providing monetary support when you need it most. Knowing how to navigate the claims process effectively can make a huge difference in getting the support you deserve quickly and smoothly.

Steps in the Claims Process

Report the Incident

Immediately after an event occurs, contact your insurance company. Provide detailed information about what happened, including date, time, and circumstances. Take photos or gather evidence if possible. Most insurers have multiple ways to report claims: phone, online portal, mobile app, or in-person at a local office. Be prepared to share your policy number and provide a clear, factual account of the incident. Prompt reporting helps speed up the entire claims process and ensures you meet any time-sensitive requirements.

Document Everything

Collect and organize all relevant documents related to the incident. This might include police reports, medical records, repair estimates, receipts, and photographs of damage. Keep a detailed record of all communication with the insurance company, including names, dates, and conversation summaries. Good documentation supports your claim and helps prove the extent of your loss. The more comprehensive your evidence, the smoother your claims process will be.

Insurance Adjuster Investigation

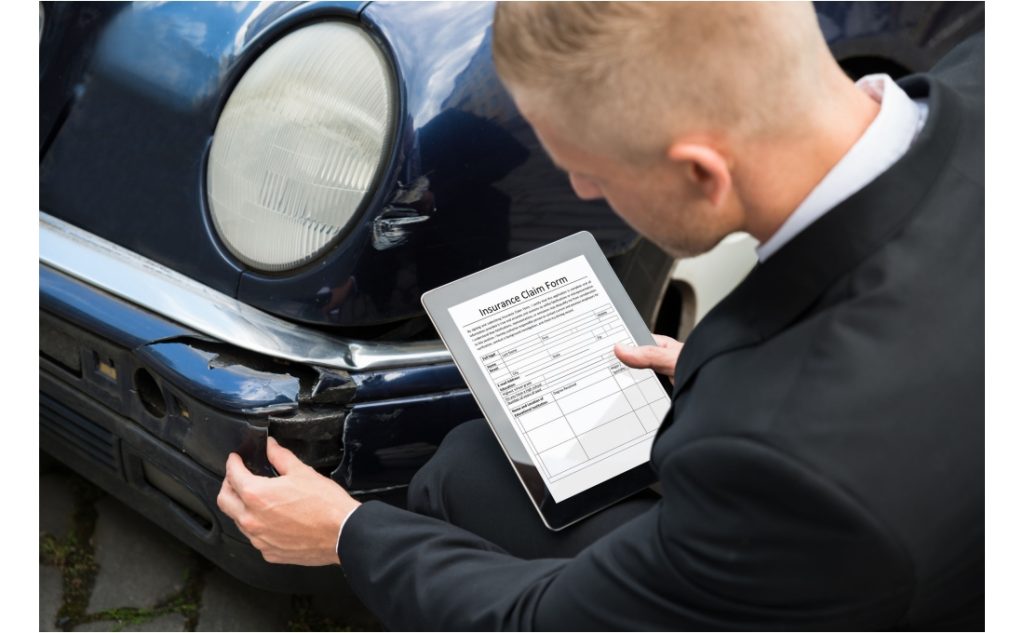

An insurance adjuster will investigate your claim. They’ll review your documentation, assess the damage, and determine the claim’s validity and value. The adjuster might visit the site of the incident, interview witnesses, or request additional information. They’ll evaluate your policy coverage and calculate the potential payment. This step ensures that the claim matches your insurance policy’s terms and conditions. Being cooperative and providing clear, honest information helps this process go smoothly.

Claim Evaluation

The insurance company reviews the adjuster’s report and determines the claim’s approved amount. They’ll compare the damage against your policy’s coverage and any applicable deductibles. You’ll receive a detailed explanation of how they calculated the payment. If the claim is approved, you’ll be notified of the amount and when you can expect payment. If denied, the company will explain why and provide information about potential appeals.

Receive Payment

Once approved, you’ll receive compensation through various methods like direct bank transfer, check, or sometimes direct payment to service providers. The payment amount depends on your policy’s specifics and the documented loss. Review the payment to ensure it matches the agreed-upon amount. If you disagree with any aspect, contact your insurance company to discuss further.

Conclusion

The claims process might seem complex, but it’s designed to help you recover from unexpected events. Stay organized, communicate clearly, and understand your policy’s details. Keep all documentation, be patient, and don’t hesitate to ask questions. Each insurance company has slightly different procedures, so familiarize yourself with your specific policy. Approach the claims process methodically, and you’ll increase your chances of a successful, stress-free resolution.